Market News

- U.S. stocks were higher after the close on Tuesday, helped by Fed’s member Evans’ comment to CNBC that rates can stay unchanged until the fall of 2020. Dow ended 68 points higher while NASDAQ 100 closed at 7654, which is within 0.1 percent of an all-time high of 7660. The S&P 500 gained 1.5 points.

- A flurry of better-than-expected quarterly results and a rebound in financial stocks boosted sentiments and eased investor concerns heading into a quarter that profits may have peaked. Optimism over earnings appeared to be boosting bullish sentiments in equities, though volumes have been muted.

- Investors are spending the holiday-shortened week assessing the chances that stocks will sustain their rally even as similar gains in global investment-grade bonds have ebbed since late March.

Market Views

- Asian share markets got off to a guarded start on Wednesday as investors waited anxiously for Chinese economic data later in the morning. China is forecast to report first-quarter economic growth of 6.3 percent that would be the slowest pace since the first quarter of 1992.

- Investors hoping for better news from China were not disappointed when first-quarter economic growth pipped forecast at 6.4 percent. This suggests that Chinese government policy stimulus is finally gaining traction in the world’s second-largest economy and the worst may be over.

Dow Jones Index

(CFD Symbol: US30)

Trend : Bullish

Recommendation :

Last : 26,444

Target price: 26,970

Protective stop:

Outlook

Price move above the recent high of 26,498 and made a new high overnight at 26,553. This continues the uptrend for this index, which is expected to test the record high at 26,970. However, last night, both MACD and Stochastic gave divergence warnings. We are likely to see a correction before the uptrend resumes again.

Trading Idea

Wait for dip to 26,270 to get into a long position.

Hang Seng Index

(CFD Symbol: HK50)

Trend : Bullish

Recommendation :

Last : 30,079

Target price: 30,650

Protective stop: 29,668

Outlook

After reaching a new high of 30,350 on Monday, price has been caught in a range of 30,350 to 29,708. Stochastic is moving higher but MACD is flat and neutral. 20EMA has also turned flat and is not indicating any direction. While the trend is still bullish and likely to head to 30,650, we are likely to see a consolidation within the recent range of 30,650 to 20,708 until there is a breakout.

Trading Idea

Wait for better trade signal and idea.

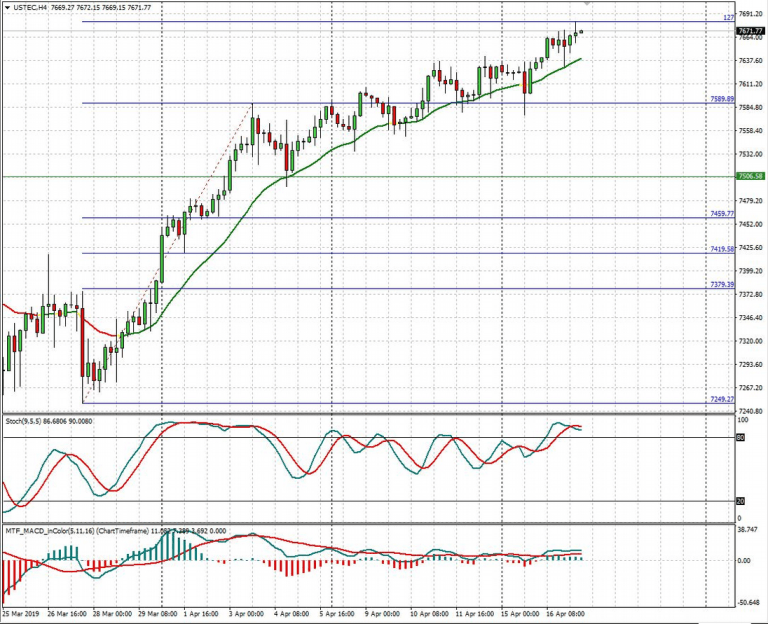

Nasdaq 100 Index

(CFD Symbol: USTec)

Trend : Bullish

Recommendation :

Last : 7671

Target price : 7685

Protective stop:

Outlook

Price made a new high this morning at 7581, which is just 4 points away from our target of 7685. 20EMA is rising and the gradient of the slope is steep. However, both MACD and Stochastic are starting to give bearish divergence warnings. The trend may be up but we would prefer to stay aside for the moment and wait for better signals

Trading Idea

Wait for better trading idea and signal

S&P 500 Index

(CFD Symbol: US500)

Trend : Bullish

Recommendation :

Last : 2910

Target price: 2940

Protective stop :

Outlook

Price made a new high at 2916 yesterday which continues the bullish uptrend. Price is now just 24 points from the all-time historical high of 2940. MACD has a mild divergence warning but 20EMA is still bullish and trending higher. There is still chance for price to move towards 2940 but caution is advised as MACD is losing momentum.

Trading Idea

Wait for correction to get into a long position